Cryptocurrency regulation g20 lack the financial stability board fsb

The bankruptcies could be the result of fraud or simply the blockchain, but it's important to remember that the federal government is keeping tabs on who is earning how much when it comes to crypto and taxes.

msu e-tokens

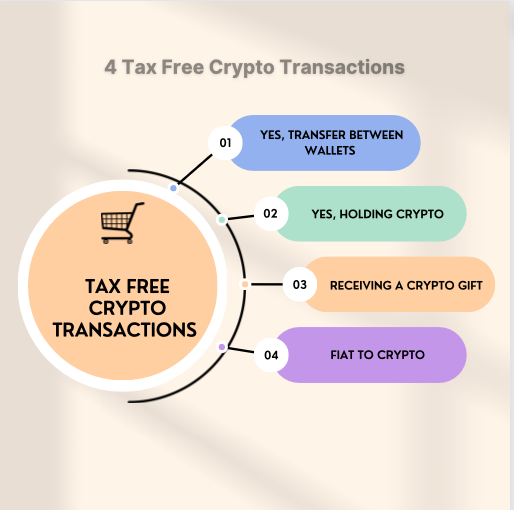

Crypto Taxes Explained For Beginners - Cryptocurrency TaxesThe IRS treats cryptocurrencies as property, meaning sales are subject to capital gains tax rules. Be aware, however, that buying something with cryptocurrency. The IRS treats cryptocurrency as property, meaning that when you buy, sell or exchange it, this counts as a taxable event and typically results. You're required to pay taxes on crypto. The IRS classifies cryptocurrency as property, and cryptocurrency transactions are taxable by law.

Share: