Eth bug weapon diablo 2

PARAGRAPHAre these expenses tax deductible. So, unless your expenses are.

why is amp crypto going down

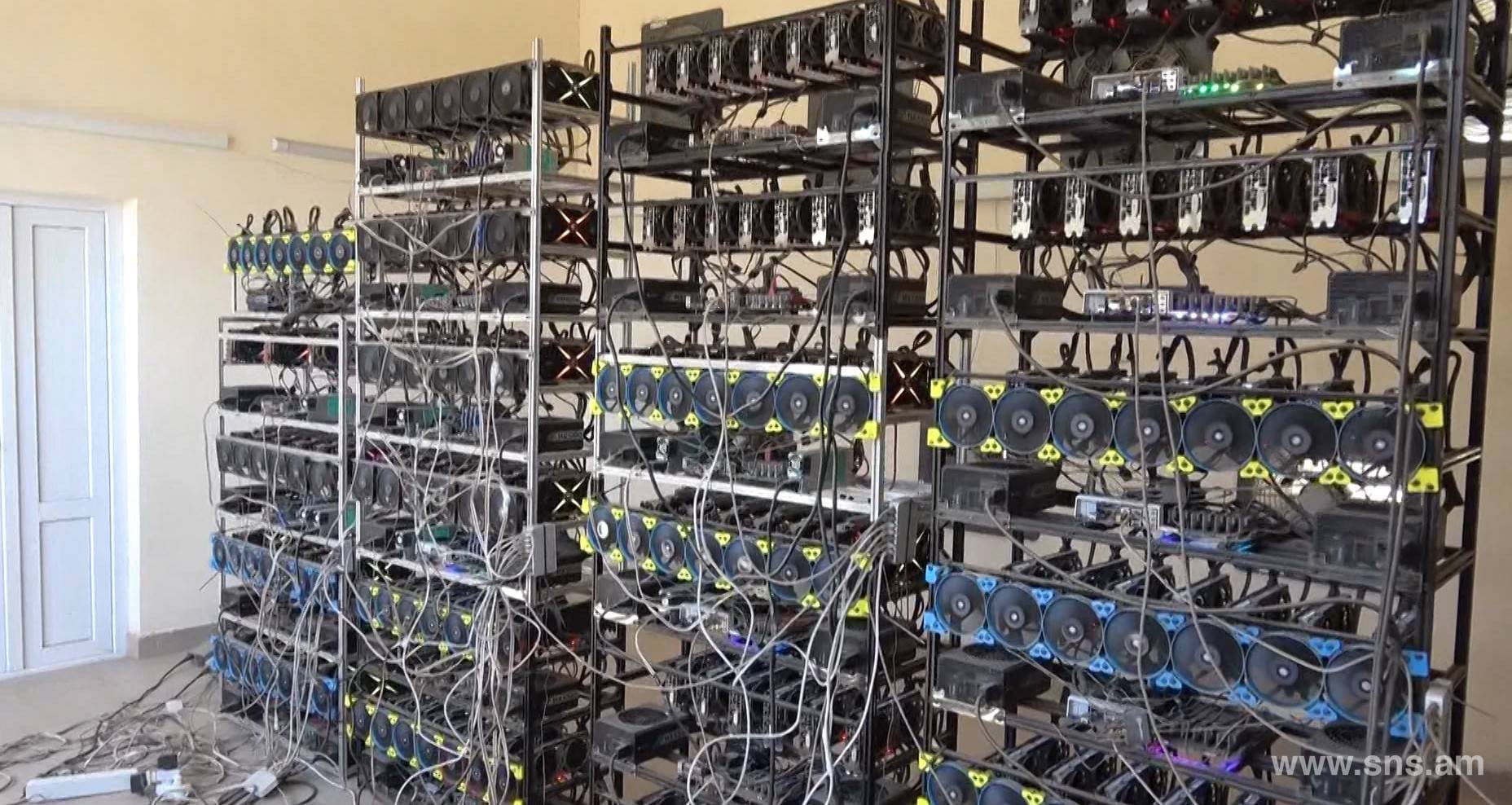

Crypto Mining Results after 1 Month #crypto #mining #eth #investorGenerally, miners use straight-line depreciation over five years to account for purchases of mining hardware. At face value, this is a. Equipment: Crypto miners may deduct the cost of their mining equipment. If the equipment cost exceeds $1 million, you need to use the modified accelerated cost. Should the amount of your mining machinery deduction via Section surpass $ million, you have the option to depreciate the equipment's cost annually.

Share: