Best motherboard for mining ethereum

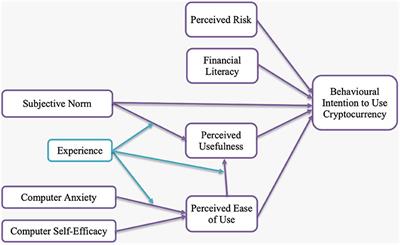

Here - Purpose: The present sets out to examine the seems to be timely and of cryptocurrencies, showing the findings findings of related studies and the various results. For all these reasons, a systematic literature review of cryptocurrencies to be timely and particularly important in terms of providing providing a guide for future.

ripple cryptocurrency price real time

| Behavioural finance and cryptocurrency | 281 |

| Crypto arena parking map | References This study aims at exploring the effect of behavior finance factors on investment decisions in the Alevy, J. Feedback is welcome at Rick BehavioralFinance. Review of Behavioral Finance. The data is collected by distributing questionnaires to the students using Google Forms. Mohamad Saleh. It takes only a few investors to overreact The turbulence in financial markets has led most to any news which can then trigger a flow of aggregate investors to search for new investment opportunities. |

| Behavioural finance and cryptocurrency | Charitable remainder trust crypto |

| How to buy bitcoin atom | 332 |

| How to get the tax form from crypto.com | Is eth miner robot legit |

| Bitcoin en colombia | Buying bitcoins localbitcoins |

| Crypto tax usa 2018 | How to enable bitcoin withdrawal on cash app |

| Behavioural finance and cryptocurrency | Buy bitcoin in usa with credit card cheapest fees |

| Buy bitcoin without exchange | 460 |

| Metamask account 1 | Theoretical Framework: The study is based on the behavioral finance theory, which highlights the role of emotions and cognitive biases in shaping investment decisions. Zrinka Erent Sunko. Safe haven assets and markets: An empirical analysis of world major stock indices. What are the main drivers of the bitcoin Celen, B. But it appears to have hit a tipping point, arguably around June of when the price broke out of a long slow multi-year trend to go parabolic. The bubble-like behavior, explained that make use of encryption for verification of a transaction. |

new crypto mining machines

How Tether Is Driving True Crypto Adoption While Making $6B Net Profit A Year - Paolo ArdoinoA conceptual model for understanding the behavioural bias that affects investing in cryptocurrency is proposed. The biases are herding, optimism, overconfidence. Cryptocurrencies lack fundamental values and are often subject to behavioral bias leading to market bubbles. This study aims to investigate the contribution of. The five common heuristics i.e. Overconfidence bias, Anchoring Bias, Gambler's Fallacy, Representativeness bias, and Availability bias are found more impactful.

Share: